The Bank of England (BOE) -- custodian for LBMA’s (London Bullion Market Association) biggest players -- is now delaying gold withdrawals for 4-8 weeks. If they can’t deliver, what does that say about the system?

THE POTENTIAL MOMENT OF TRUTH

A LBMA de facto default: this major data point just dropped.

Fiat alternatives as a strategic asset: to fight inflation and a broken money system.

Shockingly little transparency in the precious metals market, so we are forced to figure this out on our own.

Early conclusion: fiat alternatives are a thing.

THE SET-UP: WHY THIS MAKES SENSE

Multiple signals: LBMA news makes perfect sense, tying together all the recent signals of physical market tightness we’ve been tracking -- EFPs (Exchange for Physicals), lease rates, and borrow costs -- all moving higher.

Major risks: the risks are real, they are big, and the ripple effects are profound.

FUN WITH NUMBERS: HOW TINY THE PRECIOUS METALS MARKET REALLY IS

BOE numbers are puny: BOE holds roughly $450B worth of gold. Since the election, nearly 400 metric tonnes (between 5-10% of BOE’s current holdings) have been transferred to the COMEX. The value of this transfer – just $35B -- could be found in the couch cushions at the Eccles Building (home of the Federal Reserve).

Perspective check: The Department of Defense consistently fails their audits and cannot account for $2T in assets. The Chinese property market has lost over $10T, and NVDA lost $600B in a day – yet is still one of the biggest stocks in the index (alongside AAPL).

Poof: the wealth management industry now manages $125T. A simple 1% allocation into gold would create chaos.

We’re officially throwing around trillions: don’t get us started on silver -- a much smaller market that has been running in structural deficit for over four years.

HISTORY SAYS THIS IS INEVITABLE

The Covid jolt: the inflation genie was unleashed with massive “money printing”.

The seeds have been sown for decades: bailout nation is the name of the game.

Structural tailwinds (all depleting physical): any one of these is big and we have many!

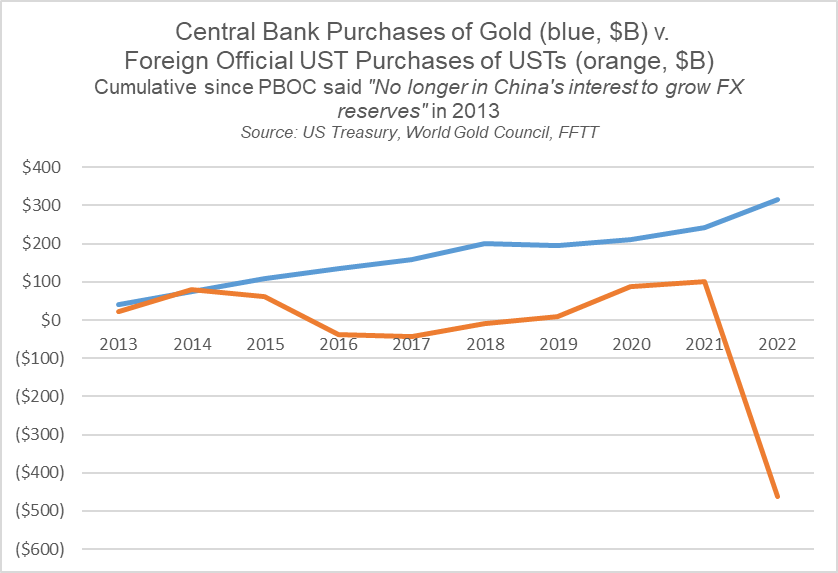

The freeze and seize: the West’s freezing and seizing of Russian sovereign reserves was an “oh shit” moment. Fiat alternatives got this memo in mid-2022 and haven’t looked back.

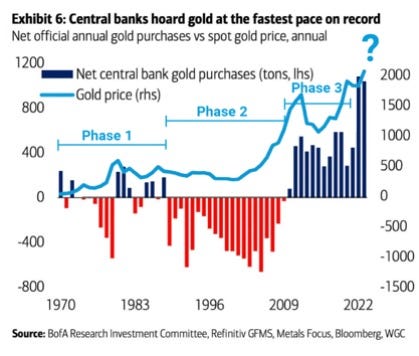

The Central Bank phase shift: we are in an acceleration phase.

The paper/physical leverage: there are WAY more paper claims than actual gold (and silver). We’ve covered this in A Silver Heist: Part 2

Basel rule changes: gold is now the only other tier 1 asset along with Treasuries. Banks and other institutions are adjusting their balance sheets and moving into allocated gold and away from unallocated.

BRICS buying: one way and relentless.

The battle at the top: treasuries vs. gold.

MONEY SYSTEMS CHANGE

Totally unsustainable: it all comes back to the money system. Powell, Fink, Dimon, and Dalio have all used the same word, “unsustainable”.

Clarity on the horizon: our two big questions -- when it happens and what it looks like -- may be getting answered.

The ultimate irony: real money (gold) takes down the fiat money system. Poetic.

Potential chaos scenarios: we’ve written about Ice Nine, Crack-up Boom, and Pencils Down in Snap! Crackle! Pop! All potential outcomes of this Final Fiat Fiasco (#FFF).

Not fear porn: this is risk management, and we have solutions!

PERCEPTION IS EVERYTHING

The biggest risk of the bunch: perception drives behaviors – and makes this the biggest risk of them all.

One big abstraction: the entire system is built on trust.

The power of FOMO: we just saw the Trump Coin trade at a cool $72B.

THE RISKS ARE MASSIVE: THIS IS FOR ALL THE MARBLES

Hard to comprehend: the risk and implications of a new money system are difficult to wrap our heads around.

Can’t ignore: It’s worth having these conversations.

REFLECTION & CURIOSITY

At your bank: if your bank delayed withdrawals for 4-8 weeks, would you call that normal?

At your brokerage: if they couldn’t settle trades for two months, would that be fine?

About gold: If you buy gold and can’t get it, do you really own it?

Slowly then suddenly: they’ll call it a “queue.” We call it what it is -- a slow-motion default.

SOLUTIONS: HOW TO POSITION

Inside the portfolio: an allocation to fiat alternatives, real assets, and primary wealth.

Outside the portfolio: personal resilience. Fill all your buckets of wealth: knowledge, emotional, time, and community.

Take the first step: it starts with awareness…then focuses on execution.

Build it. Live it. Protect it.