Intro

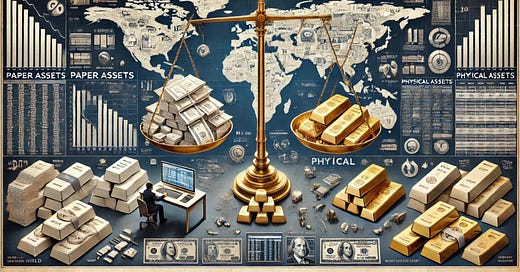

After learning about index arb, EFPs, and hard-to-borrows in Part 1, you are now a pro trader. We covered the concept of hedging physical assets with paper assets: long a basket of S&P 500 stocks against a short in the S&P 500 futures (paper derivatives). And now we will take a look at how this paper vs. physical game can be played in the precious metals markets – silver and gold. We will use them interchangeably, as most concepts apply to both.

We will now explore some of the major differences between paper precious metals vs. the real thing: the physical assets.

NAKED SHORTS ARE A CULPRIT

It starts with the precious metals prices being set by the paper markets: the COMEX (Commodity Exchange in the U.S.) and LBMA (London Bullion Market & Association). It is the paper (futures) markets that influence spot prices, which are the prices used for the settlement of derivatives, including physical deliveries. So the physical markets are driven by paper pricing.

The physical markets are a different beast. There are several ways to access the physical markets: you can visit your local precious metals dealer, you can purchase and store precious metals with online accounts, or you can exercise your futures (stand for delivery) and redeem your paper futures contract for physical precious metals.

KEY CONCEPT ON NAKED SHORTS: it is important to note that one does not need to own the physical metals (or have to borrow) in order to execute a sell order in these paper futures markets. This is different than the stock market, where one needs to borrow shares in order to short. This is called “naked shorting”, and this opens the door to funky price action.

From there it is not a big leap to conclude that these paper prices are manipulated lower. The paper price manipulation has gone from conspiracy theory to fact with all the charges, subpoenas, and fines in the precious metals markets over the years. The big recent bust resulted in a $920M fine for J.P. Morgan last year. You can read more here.

MONEY SYSTEMS CHANGE

We’ve written about how money systems change. Silver and gold have been forms of money on and off for 5k years. And let’s not forget that silver and gold are also both written into the constitution:

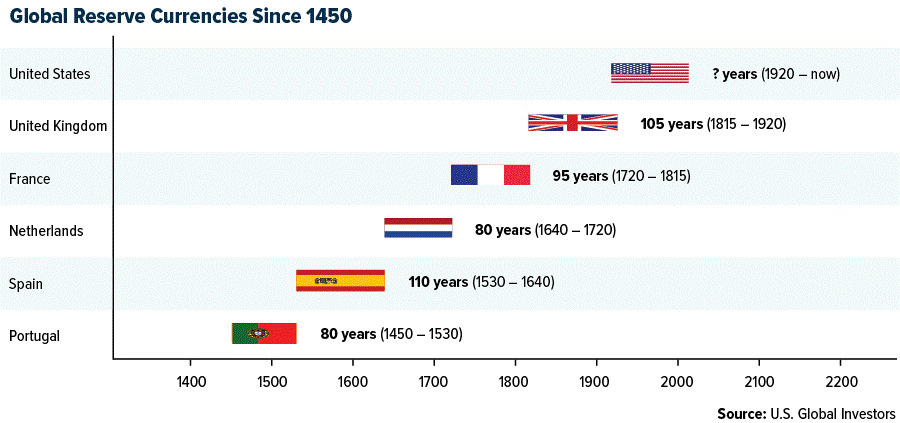

And here is a picture of how the world’s reserve currency has changed over time:

Through this lens, we know that moneys systems change, and precious metals are part of the story.

PAPER SMASHES

We are concluding that somebody (let’s refer to this unknown somebody as “Goliath”) is using naked shorts to manipulate paper precious metals prices lower. This paper price suppression makes perfect sense from an aligned incentive perspective, as silver and gold are seen as competing currencies. A vote for precious metals can be seen as a vote against our current currency system (and government), thus Goliath has a real incentive to suppress precious metals prices. All our concepts here apply to both silver and gold. Silver happens to be a much smaller and more volatile market, but both paper markets are victims of paper smashes – when Goliath aggressively sells futures to suppress the price.

Here is a favorite chart which supports the price suppression in the paper markets. We can see that the price of gold when the US paper markets are open has radically under-performed the price of gold outside of COMEX trading hours. Trust your lyin’ eyes:

A NEW GEAR

The price suppression game (market manipulation) hit new heights when the US froze Russian sovereign assets for its part in the Ukraine invasion. This act sent the world a loud message that their assets are not safe in the West’s hands. A quick reminder that commodities such as gold, oil, and others are mainly priced in dollars. For this reason, most foreign countries are holding US dollars in reserves to transact commodities. The US has already been accused of bullying and weaponizing the dollar through sanctions, but the freezing of $300B of Russian assets was a step too far. There is only one thing that could be worse than the US freezing other’s sovereign reserves, and that would be the seizing of said reserves. And yes, they did just that.

THE FREEZE: https://www.reuters.com/world/europe/what-where-are-russias-300-billion-reserves-frozen-west-2023-12-28/

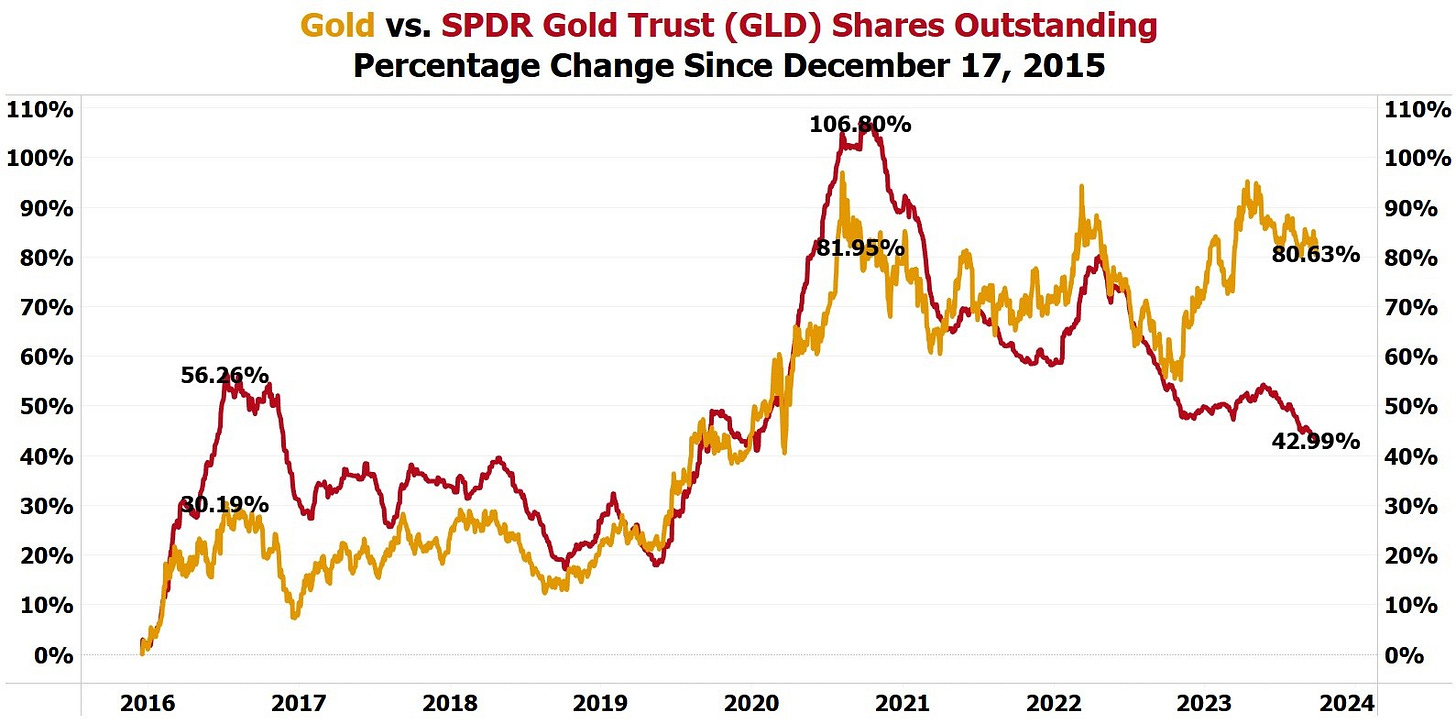

This shot across the bow set off a smart rally in precious metals (and another fiat alternative – Bitcoin). We noticed a few changes over the past year. Below is a graph of the GLD (the largest gold ETF) and the GLD shares outstanding. Reminder – GLD is a paper representation of gold; a paper asset and a derivative of physical gold. The freeze and seize message was loud enough to have the GLD price decouple from the GLD shares outstanding: the GLD was faced with redemptions yet the price of gold was still moving higher. It is clear that the physical demand for gold more than offset the GLD redemptions. There are other nuances to this relationship but suffice it to say – the world is watching…and acting. There are a few potential reasons for this disconnect, but the data remains the same – something has changed.

DESPERATION

We now have a problem on our hands. The blatant weaponization of the US dollar has sped up the de-dollarization process (the world selling their dollars) - that’s the bad news. The worse news – the precious metals suppression game just got a lot more expensive for Goliath. With the world turning to gold, Goliath will need to dig in their heels for a much bigger fight.

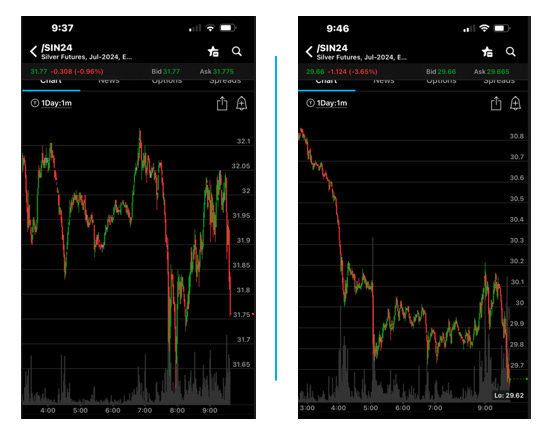

To offset the new global demand for silver and gold, and to contain silver and gold prices, Goliath is forced to sell paper contracts more often and in bigger sizes. What used to be a random event is now commonplace. We see paper smashes every day and often multiple times a day (see graphs below).

Below are recent daily “tic charts” days to show the games being played. Whether it is in the wee hours of the night when volumes are light and the US crowd is sleeping, or early in the morning when the US paper markets open, we see several gaps lower in silver. These gaps are over 1% and sometimes as much as 3%. The only player to execute in this fashion is one who is not sensitive to profits and losses. After our 25 years in the derivatives trenches and running all sorts of transaction forensics, we’ll conclude that this is not normal.

We can conclude that this price action is unnatural for the following reasons:

Nobody trades like this. It makes zero sense to dump such a large amount of contracts/notional dollars with no regard for price. The market impact of these smashes in the silver market is often well over 1%, which is an extremely costly execution. The only participants who would execute in this manner are players who are not price sensitive. Hint #1.

The second hint is that these price smashes often take place in the middle of the night when nobody is around, and volumes are light and early in the morning when the US paper markets open. This allows for a much larger market impact: mission accomplished.

WARNING SIGNS

We also know that the paper silver and gold markets are fractionalized, just like our fiat paper-based fractional banking system. This adds to the risk, as there are not enough physical assets to go around. The paper markets dwarf the physical markets. Unfortunately, we have no idea how extreme this out-of-balance is in silver and gold due to the lack of transparency in the derivatives markets.

We experienced an interesting warning shot during Covid. When the general market had its first major move lower (the S&P 500 declined over 30% in a month), most everything got thrown out and traded down. SLV (paper silver) was down over 35% in a few weeks. Yet, at the same time, the physical price of silver not only held steady, but there was a mini run on the physical (people trying to buy physical). There were silver shortages, and many dealers were posting delayed delivery times 3-10 weeks out...if you can even find what you are looking for. So, as paper silver traded down and physical was flat and the premium on the physical coins reached almost 100% of spot (paper).

A more recent data point shows the silver paper/physical spread on the move again. We can compare the price of Shanghai physical silver against the LBMA paper silver and see that the physical premium had widened to roughly $4 over the past year:

THE CLOSE

We hope you now have a better understanding and an appreciation of the difference between paper assets and physical assets. Each come with their own set of rules, different exchanges, and unique demand/supply forces.

A logical question would be to ask where the regulators are in all of this. Unfortunately, they are hiding in the bushes, just like the credit agencies did in 2008. There is a little info in the fact that Fort Knox has not been fully audited since 1974. There are several organizations and individuals that have spent a lot of time, energy, dollars, and letters to government to get to the bottom of the precious metal’s secrecy, but nobody has broken through. Ted Butler was one of the great fighters in this story, and we’ll honor his recent passing with a shout-out for his amazing work in this space.

Until we get more and better data, it is up to us to gather the info, connect dots, and determine probabilities. It is a shame that the most liquid and transparent markets are run with this level of secrecy.

Stay tuned for Part 3, where we’ll share a theory for a precious metals rug-pull for the ages.

Great stuff, thank you. Well researched and adds to the pile of evidence against the banksters.

As to why regulators are apparently asleep at the wheel, well the answer is obvious. They are baby banksters and it's in the gooberments best interests to keep real money murky and slimy so noone understands it. Because knowledge is power, and they need a public that is uneducated so they can continue to take advantage.