SNAP! CRACKLE! POP!

INTRO

Money systems change. It’s a fact of life. The trajectory of our debts and deficits is unsustainable, and our fearless “leaders” apparently agree.

POWELL: https://thehill.com/homenews/4447860-powell-the-us-is-on-an-unsustainable-fiscal-path/

DALIO: he’s been talking about this for a while now.

If the dollar ever lost its status as the world’s reserve currency, we’d be in a heap of trouble. If the US had to live within its means, life would be “different”. With that as the backdrop, we are left with two major unknowns: when it will happen, and what it will look like.

It’s all guesswork. It may not happen in our lifetime, but we won’t be surprised if it happens overnight. As for what it will look like, we see it as a process. We can have competing money systems, as currencies fall in and out of favor -- it doesn’t have to be binary.

Enter Covid. We think Covid shed light on our two unknowns – or rather, Goliath’s response to Covid gave us a hint at some answers.

SNAP: QE INFINITY

The government’s response to Covid mirrored their approach to most every market hiccup: “printer go brrr.” Over 18 months, the Fed unleashed $5 trillion in newly created currency units into the system. This was Quantitative Easing (QE) to the moon and back.

The Covid SNAP marked the beginning of the end. Other countries followed suit, and this unleashed inflation worldwide. Of course, the seeds of inflation have been sown for decades -- so it was only a matter of time.

This Covid jolt changed the odds on the timing of a new money system. The process has been sped up, and we can see the finish line. The inflation genie is out of the bottle, and there’s no putting her back. Inflation is here, it’s global, and she’s a monster. Inflation is what has taken down most empires and money systems. The global onslaught of currency units has us revising our guess on timing to: “sooner rather than later”

We also got a glimpse of what “it” will look like. We’ve always said, “There are a thousand snowflakes that can trigger the next avalanche.” Covid gave us a clearer picture. While we haven’t pinpointed the specific snowflake, we have a better idea on the process: a currency crisis. Of course, that’s the answer – it’s always the answer. It was a currency crisis that took down:

Roman Empire (3rd–5th Century CE)

Ming Dynasty (China, 14th–17th Century)

Spanish Empire (16th–17th Century)

Ottoman Empire (17th–19th Century)

French Monarchy (1780s–1790s)

British Empire (1918–1945)

Weimar Republic (Germany, 1921–1923)

CRACKLE: THE BOND BEAR MARKET

We’re getting closer to the truth - how exciting. The Covid response unleashed global inflation, a catalyst that may speed up the process towards a new money system.

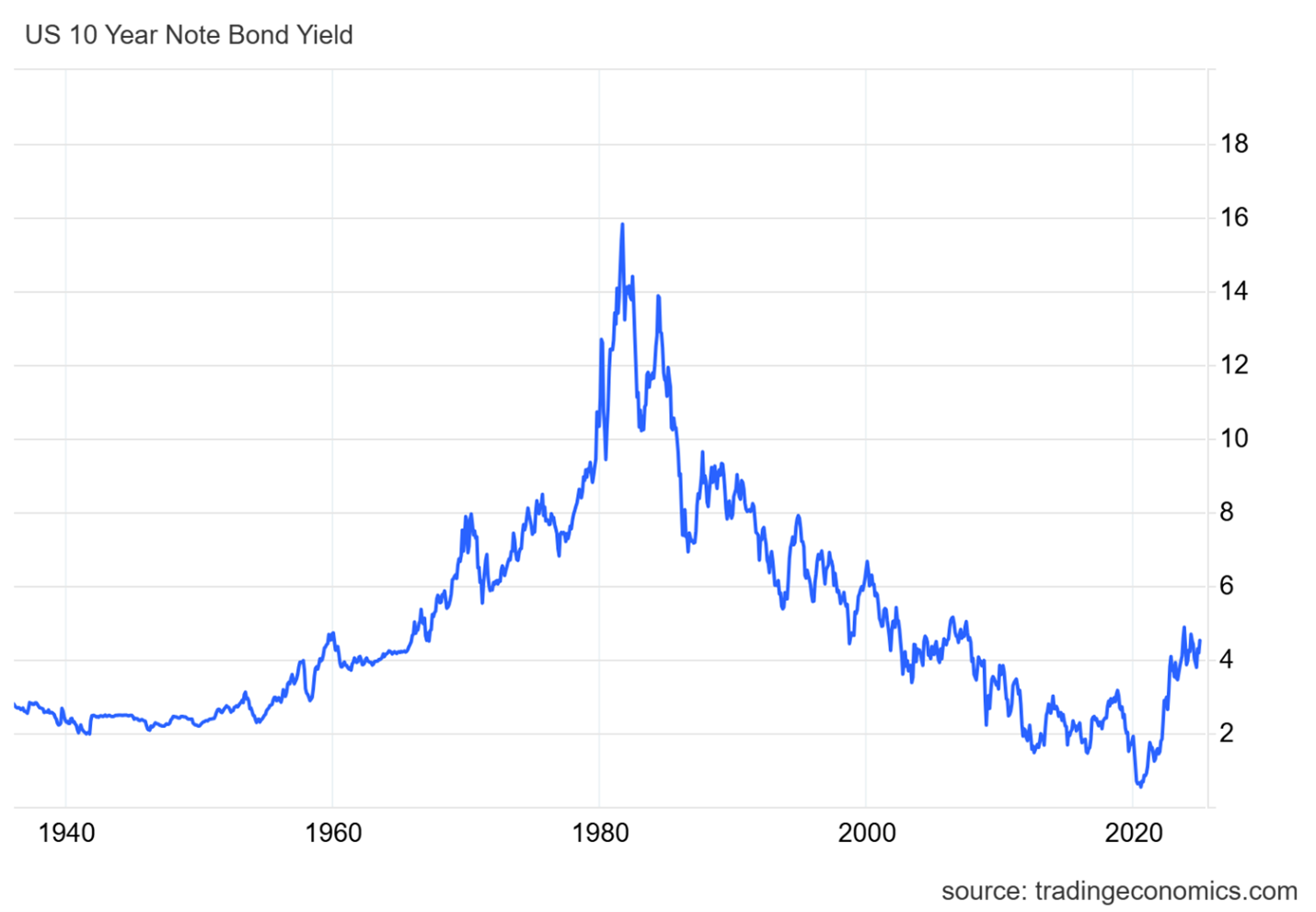

We can see this playing out before our eyes. It’s all about rates. Interest rates are the cost of money, and they’re on the move -- higher. Covid rang the bond bear bell:

The bond bear market has been raging for over four years. The two previous rate cycles each lasted 40 years, so we may still be in the early innings. Intuitively, it makes sense for rates to climb as demand for money surges in an over-indebted world -- everyone needs cash to cover their debts and deficits.

There are countless estimates for total global debt. We have actual debt, unfunded liabilities, and the derivatives elephant in the room. Depending on who is counting and how, the numbers are staggering. Billions used to be big; now we are deep into the trillions -- and thanks to derivatives, we’re venturing into the quadrillions.

The only reason rates didn’t move earlier is because of rate manipulation. The Fed buys its own bonds to keep a lid on rates – that’s what QE (Quantitative Easing) is all about. As the buyer of last resort, the Fed creates “money” out of thin air to fund these purchases, which simply adds to the debt pile. The can keeps getting kicked, as the global game of money-for-nothing rolls on.

Now we are facing a global bond bear market with rising rates on an over-indebted planet.

POP: THE TIPPING POINT

As much as the powers that be try to repeal the business cycle with endless bailouts, support programs, and inflationary injections of currency from heaven, we have to remember that asset prices can still go down. We’ve already seen three 50% corrections this century.

Markets tend to be mean-reverting. They ebb and flow; they correct, rally, and retrace -- that’s how they work. At least that’s how they used to work.

The most crowded thought in financial circles is how the Fed would respond to a market correction. Ninety-nine percent agree: if the market hiccups, the Fed will step in and cut rates, implement bailouts, and revive their secretive four-letter programs. It’s time to explore the other side.

What if they don’t? What if they can’t intervene for some reason? We’ve already agreed this game is unsustainable. As Herbert Stein said, “If something cannot go on forever, it will stop.” Another reason to consider this scenario is because Goliath (the central planners) may actually win in such an event, as outlined by David Rogers Webb in “The Great Taking”.

#FFF: THE FINAL FIAT FIASCO

We can’t be too worried about 50% corrections, as we’ve already lived through plenty. The real problem is - what if things break? What if we’ve pushed too hard, created too much debt, or over-played our hand? What happens then? What would this look like?

We witnessed the SNAP, we’re living the CRACKLE, and now it’s time to explore a couple versions of the POP.

ICE NINE: I first heard about this from Jim Rickards, who credits Kurt Vonnegut’s novel “A Cat’s Cradle”. The financial concept is that global interconnectedness, combined with the extreme leverage, creates a scenario where everything freezes.

It’s similar to the 1987 crash on Black Monday, where portfolio insurance was blamed as the culprit. As the market dropped, stop-loss selling (insurance against one’s portfolio) triggered more stop losses, which led to even more selling.

It is not hard to envision this playing out with the mountain of fugazi we have created.

The Wolf of Wall Street – 2013 “Fugayzi, fugazi. It’s a whazy. It’s a woozie. It’s fairy dust. It doesn’t exist.”

CRACK-UP BOOM: Bill Bonner wrote an entertaining ending, “Return of the Worldwide Crack Up Boom”. The punchline is what we call, “The Great Conversion”, where people rush to exchange their paper currency for something real before its value disappears completely.

PENCILS DOWN: Of course, we have our own theory, and ours is centered around solutions.

We’ve all heard teachers say it at the end of a test, “Pencils down!” Now, we are using this as a base case to build personal resilience. We assume a “pencils down” moment in life where everything halts: no more banks, no more markets as we know them, no more fugazi, and the big brown trucks of happiness stop rolling. What you see is what you get -- a re-rack, a reset, and a time to build from scratch.

You’re left with your own devices: your mastery, your network, and your community. A real test.

CONCLUSION

It’s the solution set of building personal resilience that best prepares us for the unknown. We have no idea how the story will unfold, so it is best to be prepared for anything. Many claim that we are all doomed if SHTF, but we do not subscribe to that defeatist attitude. There is always something we can do to improve our chances, and with a well thought out plan, we can even enhance the quality of life as we implement our defenses. A garden is a great example.

As we face these challenges, remember that while Goliath may control much of the system, it’s David’s adaptability, resilience, and community that ultimately create a winning path forward. We’ll give a shout-out to the emotional bucket of capital, the most important one. We should be mentally, physically, and emotionally prepared for all. While chaos and volatility are part of life, they also create fertile ground for new opportunities. By embracing change and preparing for the unknown, we can thrive and innovate during times of disruption.