Intro

Spoiler alert: we have another red flag in the treasury market. The latest talk is to eliminate treasury holdings from the SLR (Supplemental Liquidity Ratio) calculation, which is used to determine how much banks need to set-aside to help “manage risk”.

Seen This Show Before

The Covid crisis brought about market chaos. To manage the steep and fast decline, The Fed jumped into action and cut rates to zero and birthed QE infinity. They also eliminated the banks’ reserve requirements. The rule sounds just like it reads: banks no longer had to hold any reserves against deposit liabilities. We already know there is nothing more permanent than a temporary government program, so this reckless policy still exists today.

We’ll remind our readers that we try to over-simply to make a point. The system and web of rules are extremely complex, especially when it comes to the plumbing of the treasury market.

Another handout occurred last year when we witnessed more bank failures than the 2008 GFC (Great Financial Crisis). The big accommodative move to save the system was to allow banks to mark their (treasury) bond portfolio at “par” (100%), to avoid taking portfolio losses. This was timely and convenient, as the TLT (Treasury Bond ETF) lost roughly 30% in 2022. As a result of the 2022 bond market route (worst ever), the system is stuck with a pile of losses on the books.

Liquidity vs. Transparency

All these rule changes are meant to help “liquify” the system, thus reduce the odds of a systematic shock of sorts. But these new rules come at the expense of transparency. We’re never quite sure who is holding what, thus we can lose track of where the land mines reside.

By allowing banks to not “mark-to-market” we lose transparency and more importantly, we lose more price discovery. Because the government buys their own bonds, long ago we lost price discovery of the most important price of all - interest rates: the price of “money”.

For 10-years we saw interest rates manipulated lower as debts and deficits soared ever higher. This meant that the US (and many other countries) were able to borrow at cheaper and cheaper rates, even as their debts and deficits were ballooning. We will reiterate a favorite C&P quote from a recent presentation, “This is an amazingly simple divergence (rates lower and debt higher) that defies every rule, concept, and bit of logic in financial markets.”

Third Times a Charm

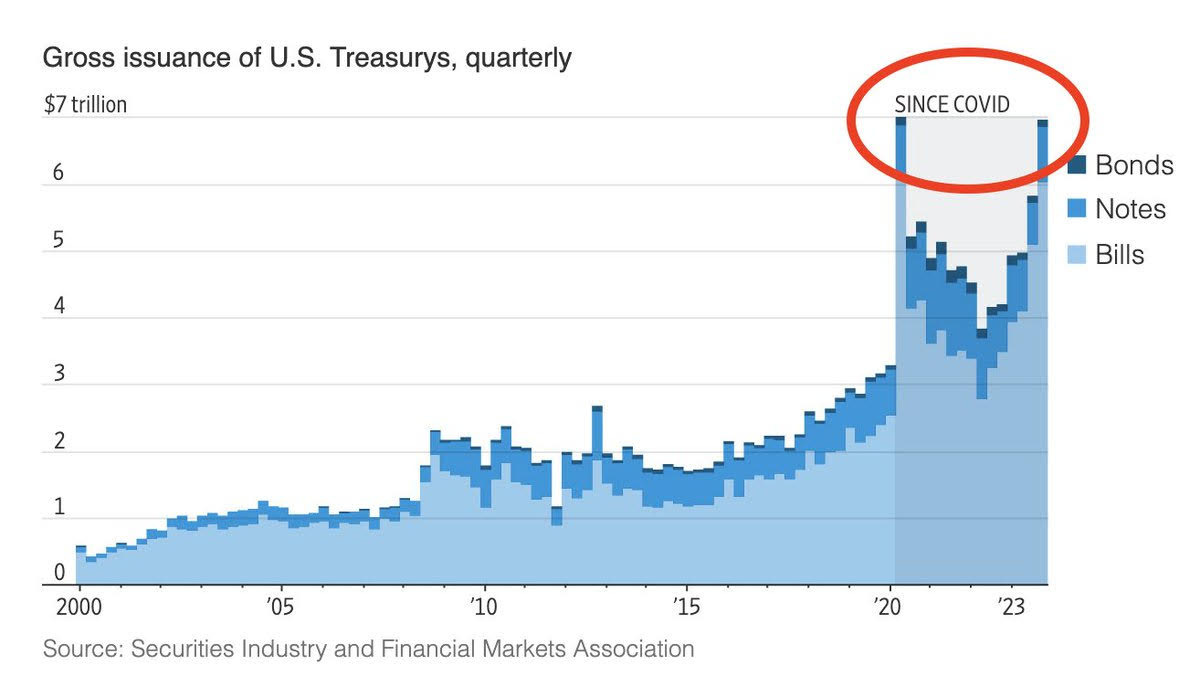

The new SLR rule change could allow banks to be an endless buyer of treasury debt. Through that lens, this rule makes a lot of sense. Especially as treasury issuance is testing the Covid highs even though the emergency is long gone. Said another way, we supposedly have a strong economy, yet the Treasury is selling/issuing bonds at a rate last seen during the Covid crisis.

The Close

How convenient for the banks -- to be able to buy treasuries, take no haircut, and not have to worry about mark-to-market losses. All just in time, as issuances are taking on a life of their own.

It is also worth noting that our deeper dive into The Great Taking (https://thegreattaking.com/) revealed that the bond market is also fractionalized (not enough to go around/some bonds held on the books by more than one owner).

It sounds like a risky proposition to keep calling our government bonds “pristine collateral”, “risk-free”, or a “safe-haven asset”.